1.Bitcoin Market

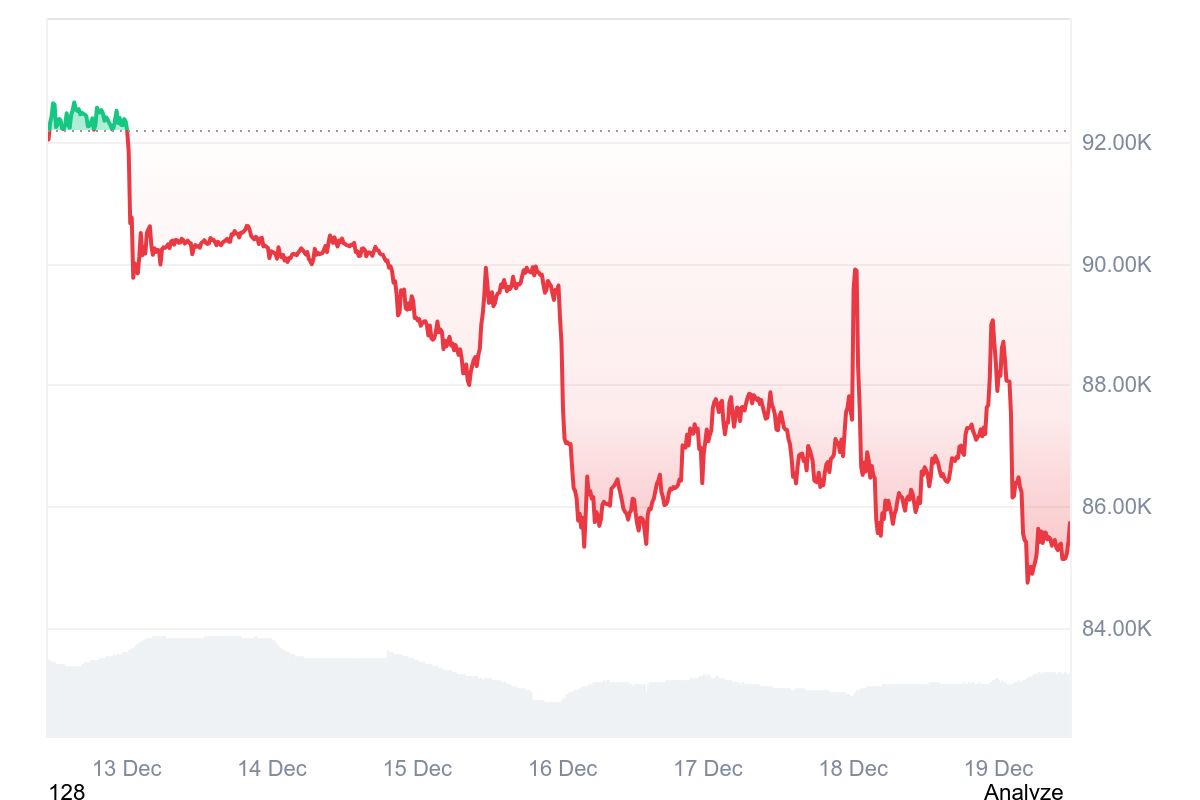

Bitcoin price movement (December 13, 2025 - December 19, 2025)

Bitcoin price movement (December 13, 2025 - December 19, 2025)

This week, Bitcoin exhibited a weak, downward-trending structure characterized by "support breach → sideways consolidation → further decline → sharp drop and wide-range fluctuations → multiple unsuccessful attempts to break through resistance." The price primarily traded between $84,746 and $92,000, with significantly increased volatility and repeated shifts in market direction. However, the overall center of gravity continued to decline, indicating a clear lack of bullish momentum.

Support level breached (December 13)

On December 13, Bitcoin experienced a rapid decline at the start of trading after remaining above $92,000 in the previous session. It quickly broke through the key psychological and technical support level of $90,000, with the decline occurring in a concentrated manner.

After falling below $90,000, the price did not rebound significantly, but instead entered a low-level sideways trading range, indicating that the previous rebound structure had been completely destroyed.

Causes of the trend:

- The previous rebound momentum has been exhausted, and the bulls lack support at key levels.

- $90,000 was a previously densely traded area; once it was broken, it triggered a concentrated release of stop-loss orders.

- Overall market risk appetite continued to decline, and funds opted for a defensive strategy.

Sideways trading and stalemate phase (December 13-14)

From December 13th to 14th, the price of Bitcoin fluctuated narrowly within the range of $89,500 to $90,200, with a significant narrowing of intraday volatility and extremely sluggish price action. The price repeatedly attempted to return above $90,000, but was quickly pushed back each time, indicating that this area has shifted from support to resistance, resulting in a brief stalemate between bulls and bears.

Causes of the trend:

- Selling pressure has temporarily eased, but buying interest remains cautious, resulting in a "directionless consolidation."

- The market is awaiting new breakout signals or macroeconomic catalysts;

- The technical picture has entered a temporary equilibrium, and a directional choice has not yet emerged.

Further downward movement (December 15th)

On December 15, Bitcoin's price weakened again, falling from around $89,000 to a low of $88,000.

A short-term rebound followed, with the price rising to around $90,000 at one point, but it failed to hold and the rebound was subsequently halted.

The price action exhibits a typical "decline-correction-failure" structure, indicating that the bulls attempted a counterattack but their efforts were clearly insufficient.

Causes of the trend:

- The previous sideways trading range was effectively broken, triggering a new round of downward movement;

- Short-term funds are trying to capitalize on a rebound, but there is a lack of follow-up buying from trend-following funds.

- The market lacked confidence in the sustainability of the rebound, and selling pressure quickly returned.

The period of sharp decline and wide-ranging fluctuations (December 16-17)

The market experienced its most volatile session of the week in the early hours of the 16th, with Bitcoin rapidly plunging to a weekly low of $85,337, a new recent low. After hitting this low on the 16th and 17th, the price did not continue its downward trend but instead entered a wide range of fluctuation between $85,000 and $88,000. The market exhibited a clear pattern of "sharp drop followed by repeated back-and-forth movements," indicating some release of bearish momentum, but the bulls were still unable to dominate the market.

Causes of the trend:

- The concentrated liquidation of leveraged positions triggered a sharp drop in prices.

- After the panic selling subsided, the selling pressure eased temporarily, and the overall market risk appetite weakened in tandem with the US stock market's technology stock cycle, dragging down the performance of crypto assets.

- Bottom-fishing buying has entered the market, but it is limited to short-term defensive funds.

The price repeatedly failed to break through resistance levels (December 18-19).

In the early hours of December 18-19, Bitcoin surged twice to test the key resistance level of $90,000, with both upward spikes occurring in a straight line, but neither attempt to break through was successful, and the price subsequently fell back quickly.

During trading on December 19th, after a failed attempt to break through resistance, the market weakened again, with prices falling below $85,000 to a low of $84,746 before rebounding slightly. As of press time, prices remain in a consolidation phase after the pullback, awaiting the next directional move.

Causes of the trend:

- $90,000 has become a clear strong resistance zone, with significant ETF funds entering the market but the bulls suffering repeated setbacks;

- With a dense concentration of trapped positions above, any rebound was met with selling pressure. Bulls faced significant resistance at the level, and profit-taking combined with selling pressure from bears resulted in a pattern of rising and then falling back. The market is currently in a "rebound attempt phase," but a valid trend has not yet formed.

2. Market Dynamics and Macroeconomic Background

Fund Flow

- ETF Fund Dynamics

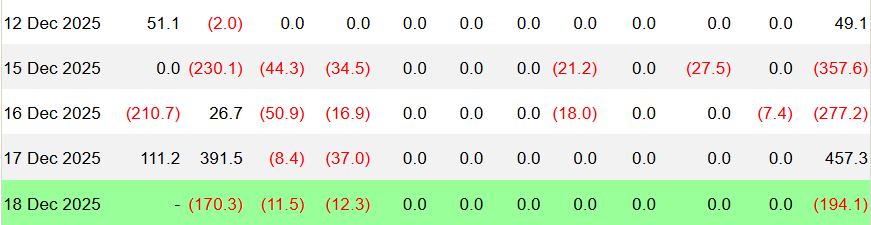

Bitcoin ETF fund flows this week:

December 12: +0.491 billion USD

December 15: -$357.6 million

December 16: -$277.2 million

December 17: +457.3 million USD

December 18: -$194.1 million

ETF inflow/outflow data image

ETF inflow/outflow data image

In total, ETFs saw a net outflow of approximately -$322.5 million this week, exhibiting a clear hedging-style flow characteristic.

In terms of timing, large-scale redemptions occurred on the 15th and 16th, with daily outflows exceeding $270 million each day, reflecting that some institutions chose to quickly reduce their risk exposure after the price broke through the key psychological level of $90,000. A significant reverse inflow occurred on the 17th, with a single-day inflow of $457 million, indicating that some funds still chose to buy on dips after the rapid price decline. However, this inflow did not form a sustained trend, and on the 18th, it turned into a net outflow of nearly $200 million, suggesting that the capital game was still mainly focused on short-term portfolio adjustments and risk management, rather than a unified bullish outlook.

Overall, ETF funds have not entered a state of continuous inflow, but have remained in a volatile and uncertain oscillating structure, and institutional judgments on the direction are still divergent.

2. Institutional buying has once again exceeded new Bitcoin supply, marking the first supply contraction in six weeks.

According to data from Capriole Investments, institutional buying of Bitcoin has once again exceeded new supply from miners for the first time in six weeks. Data shows that current daily institutional buying volume is approximately 13% higher than the amount of newly mined Bitcoin, with institutional demand consistently reducing the circulating supply of Bitcoin over the past three days.

Analysis indicates that this round of institutional buying occurred after Bitcoin's price fell by more than 30% from its October all-time high, suggesting that some institutions are accumulating positions again during a period of market pressure. Meanwhile, the US spot Bitcoin ETF saw a net outflow of over $600 million in the first two days of this week, indicating a divergence between short-term capital outflows and long-term institutional allocations.

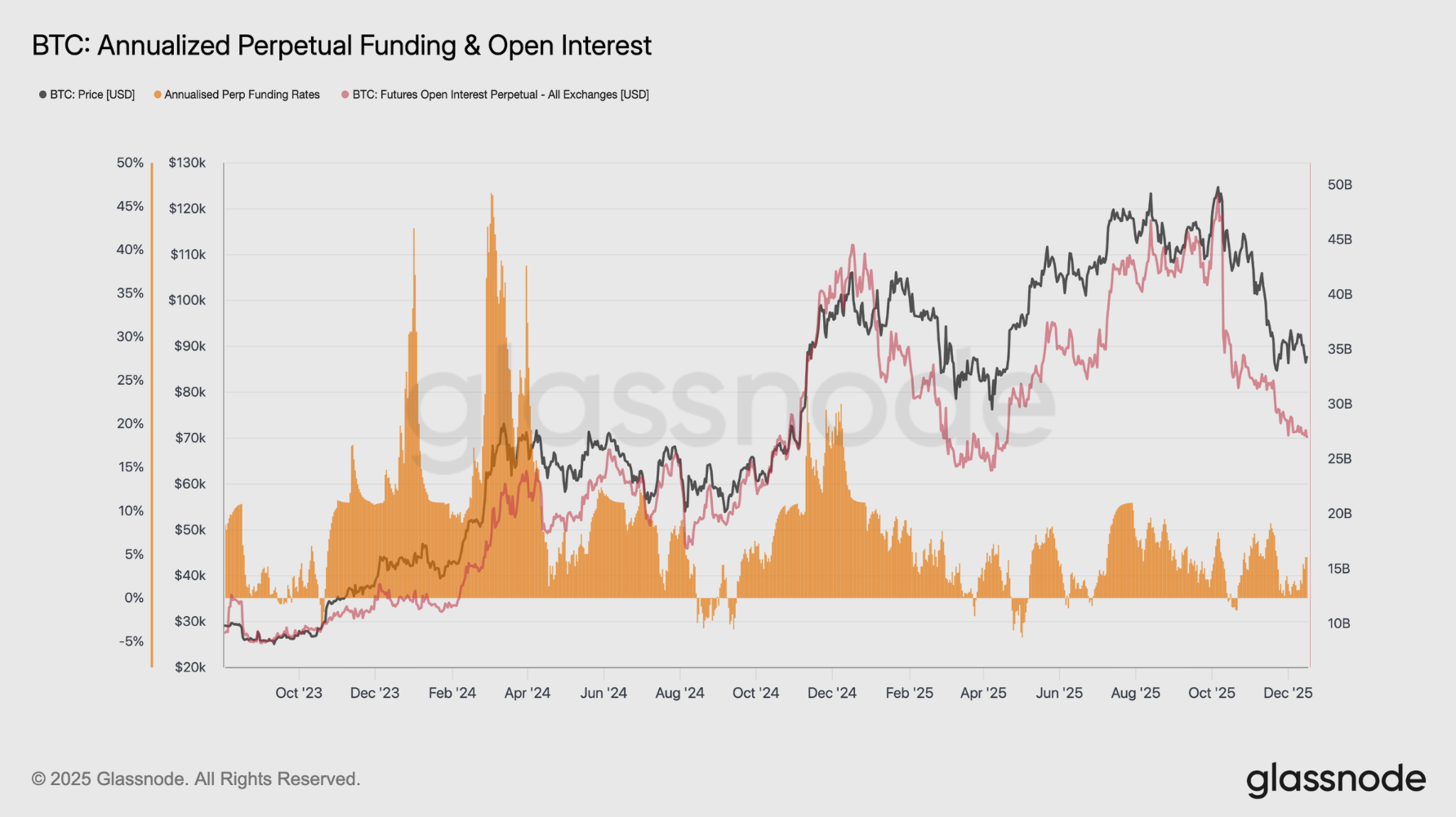

3. Futures and Options Market

Related images

Related images

The perpetual futures market continues to exhibit subdued risk appetite. Open interest continues to decline from cyclical highs, suggesting that positions are still decreasing rather than being filled with new leverage. This pullback is occurring at relatively controlled funding rates, which have fluctuated near neutral levels for most of the recent decline.

It's worth noting that the lack of sustained high liquidity suggests the pullback wasn't caused by excessive long positions or overly crowded leverage. Instead, the futures market appears to be in a consolidation phase, with traders prioritizing balance sheet management over directional certainty. With leverage reduced and funds constrained, futures allocation is no longer a major source of downward pressure. However, the absence of sustained contract liquidation also highlights the limited speculative appetite currently supporting a continued upward trend.

Following the reduction in derivatives risk, implied volatility following the Federal Open Market Committee (FOMC) meeting continued to compress at the front end, while longer-term volatility, although slightly lower, remained relatively stable. This configuration suggests that traders are actively reducing their exposure to short-term uncertainty, rather than reassessing the broader volatility system. Short-term implied volatility is most sensitive to event risk, and a decline in volatility typically reflects a decision to exit immediate catalysts.

Therefore, the current calm is not accidental. Volatility is being driven into the market, pointing to a position effect rather than market detachment or insufficient liquidity.

2. Bank of Japan interest rate hike fuels expectations of stronger Bitcoin prices.

Bitcoin fell as the yen strengthened following the Bank of Japan's expected rate hike. The Bank of Japan raised its short-term policy rate by 25 basis points to 0.75%, the highest level in about three decades, continuing a gradual shift from decades of ultra-loose monetary policy. In its policy statement, the Bank of Japan acknowledged that inflation has remained above its 2% target for an extended period due to rising import costs and more solid domestic price dynamics. However, policymakers emphasized that the inflation-adjusted interest rate remains negative, meaning that monetary conditions remain accommodative even after the rate hike.

The Japanese yen fell to 156.03 against the US dollar from 155.67. Bitcoin, the leading cryptocurrency by market capitalization, rose from $86,000 to $87,500 before retreating slightly and trading near $87,000.

The market reaction was in line with expectations, as the rate hike had been widely anticipated. Furthermore, speculators had been holding long positions in the yen for weeks, leading to a large-scale buying response after the announcement.

Technical indicator analysis

Relative Strength Index (RSI 14)

Bitcoin 14-day RSI data image

Bitcoin 14-day RSI data image

The current RSI value is around 41.25, a slight decrease from last week, and remains in the weak range. It has not yet entered oversold territory (below 30), but it also does not show any strength. The RSI is still in the weak range, indicating that the overall momentum has not been fully restored, and the bullish power remains limited.

Looking at this week's price structure, the RSI rebound is more of a technical correction of the previous rapid decline than a trend reversal signal. This also corroborates the rapid inflows and outflows of ETF funds and the lack of significant expansion in derivatives positions, indicating that the market is more of a recovery within a weak market.

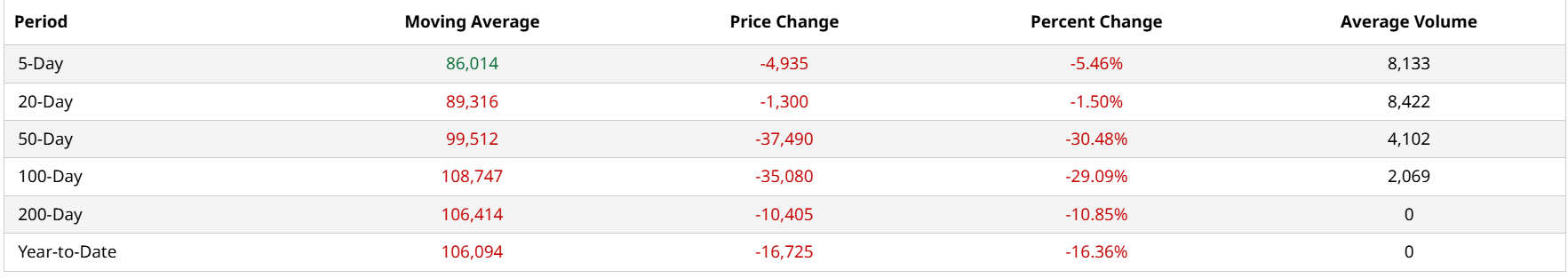

Moving Average (MA) Analysis

MA5, MA20, MA50, MA100, M200 data images

MA5, MA20, MA50, MA100, M200 data images

The latest moving average data shows:

- MA5: $86,014

- MA20: $89,316

- MA50: $99,512

- MA100: $108,747

- MA200: $106,414

Current price: $85,727

In the short term, prices have fallen below the 5-day and 20-day moving averages (MA5 and MA20), indicating weakening rebound momentum. In the medium term, the 50-day and 100-day moving averages (MA50 and MA100) continue to decline, reflecting that the market is still in a medium-term correction trend. The long-term 200-day moving average (MA200) is above $108,000, suggesting that the current decline has not yet broken the long-term bullish structure; however, if it fails to hold above $90,000 for an extended period, there is still a risk of a deeper correction in the future.

Key support and resistance levels

support level:$84,000

resistance level:$90,000-$94.000

If it falls below $84,000, it will test the lower support level of $80,000; if it rebounds and breaks through $94,000, it may retest the psychological level of $100,000.

Market sentiment analysis

Fear and Greed Index Data Image

Fear and Greed Index Data Image

As of December 19, the "Fear & Greed Index" was approximately 21 points, placing it in the "Fear" range.

Looking back at this week (December 13th to December 19th), the Fear & Greed Index was 26 (Fear), 27 (Fear), 24 (Fear), 22 (Fear), 25 (Fear), 22 (Fear), and 21 (Fear), respectively. It continued to decline compared to last week, reflecting a more cautious and even pessimistic investor sentiment.

From a trend perspective, the index has remained between 21 and 27 for several consecutive days, indicating that the market is in a state of panic and wait-and-see after BTC briefly fell below $90,000. Nevertheless, looking back at the price action over the past thirty days, the index has gradually recovered from its extremely fearful lows to its current range, showing a weakening of the momentum for large-scale selling. Once the price stabilizes again and finds support, investor sentiment may see a resilient recovery.

Macroeconomic Background

- A major turning point in the Russia-Ukraine conflict: Zelensky compromises by agreeing to Ukraine's withdrawal from NATO in exchange for Western guarantees.

On December 14, Ukrainian President Volodymyr Zelenskyy revealed in an interview that during negotiations surrounding the US "peace plan," the US and some European countries did not support including Ukraine's accession to NATO as a core component of their security guarantees.

Zelenskyy emphasized that joining NATO is Ukraine's core demand and a practical and effective security guarantee, but it has not received support from the US and Europe. Currently, all parties are working to build an alternative bilateral security guarantee system for Ukraine.

Zelensky made it clear that accepting the bilateral security guarantees rather than directly "joining the treaty" was a compromise made by Ukraine, the core purpose of which was to establish an effective mechanism to prevent Russia from "launching another conflict" in the future.

Signals of easing tensions are expected to guide funds away from defensive allocations and towards risk assets, potentially driving a short-term rebound in Bitcoin and high-beta altcoins.

Related images

Related images

2. Hawkish rhetoric from the Federal Reserve fails to quell buying pressure; Wall Street's unwavering "gold faith" propels gold prices to a fifth consecutive rise.

December 15th news, market reaction Fed further next year interest rate cut the expectation, support gold with prices rising and short-term technical indicators suggesting that gold has broken out of its recent two-week consolidation range, there is potential for further gains. Therefore, it is recommended to pay attention to the support levels of $4300 and $4285. Gold has the potential to rise further before breaking through these two levels, with the upside target being the historical high of $4381.

In the long run, this will strengthen Bitcoin's store-of-value narrative and improve the funding environment for the cryptocurrency market. Short-term trends will still depend on the pace of interest rate cuts, market expectation gaps, and the actual extent of liquidity release, but in the medium term, the weight of crypto assets in global asset allocation is expected to further increase.

3. The combined US non-farm payrolls report will be released, and the market expects a reset of the macroeconomic narrative.

December 16th news: The combined US non-farm payroll report will be released tonight, with the market anticipating a reset of the macroeconomic narrative. At 21:30 tonight, the US will release the combined November and a "fragmented" October non-farm payroll report. The market generally views this week as a minor "reset" of the US macroeconomic narrative, with the release of the non-farm payroll data considered the first shot in this process. Investors are watching to see if the downside risks mentioned by Powell will be validated.

4.Goldman Sachs warns of four scenarios that could lead to tragic outcomes for AI data centers.

On December 16, Goldman Sachs warned that if the technology industry fails to drive explosive growth in demand for AI applications and effectively monetize AI models, investments in data centers could be wiped out. The report also predicted four future scenarios, highlighting the increasing risk of oversupply in data centers.

Driven by the rapidly increasing demand for computing power from AI, investors are pouring large sums of money into data centers, fueling a new wave of construction boom in the United States and around the world. Research firm Omdia pointed out this week that, driven by AI, global data center capital expenditure is projected to reach $1.6 trillion by 2030, with an average annual growth rate of approximately 17% over the next few years.

However, the market has begun to question how much return on investment (ROI) this AI boom can actually generate. A survey conducted by Lenovo earlier this year showed that many senior executives are still unsure whether AI is worth such a high cost; another report pointed out that predictions of future demand are likely based on a great deal of speculation.

5.US stocks had a headwind start to the week: tech stock sell-offs spread, and the market fell into volatility again ahead of a key data release.

U.S. stocks closed lower on Monday as a sell-off in technology stocks continued and traders prepared for a barrage of upcoming economic data.

The S&P 500 fell 0.2% at the close in New York, erasing earlier gains and marking its second consecutive day of decline. The technology-heavy Nasdaq 100 fell 0.5%, making it the benchmark index its third consecutive day of losses.

"The positive sentiment from the early morning has dissipated, and Friday's sell-off carried over into Monday's U.S. trading session," said Chris Beauchamp, chief market analyst at IG. "After such a strong recovery since April, the temptation for many investors to take profits must be very strong, especially with a lot of macro events on the schedule this week."

Technology stocks underperformed last week due to renewed concerns about artificial intelligence. Disappointing earnings reports from Oracle and Broadcom exacerbated these concerns, offsetting the optimism generated by the Federal Reserve's rate cut.

Related images

Related images

3.Mining Dynamics

Hash rate change

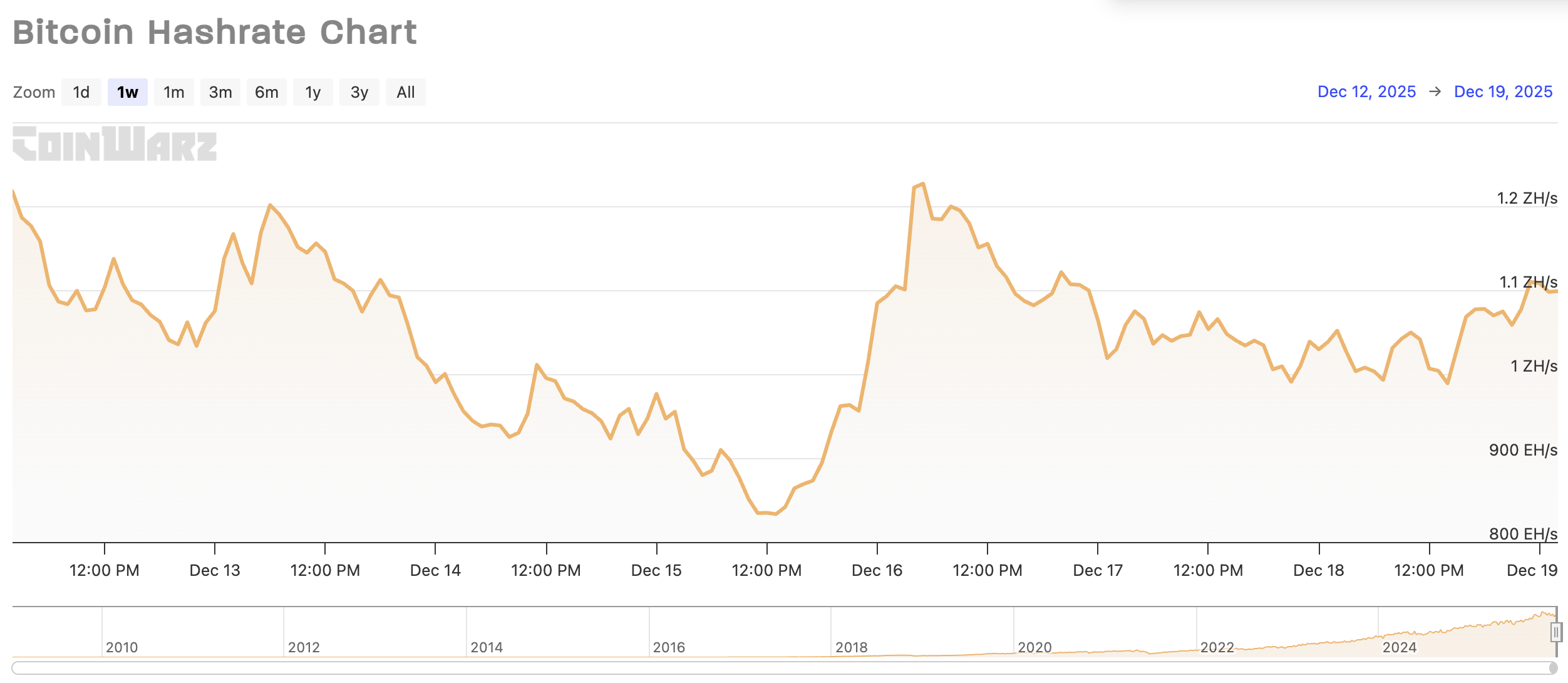

Over the past seven days, the Bitcoin network hashrate has shown a significant "V-shaped" oscillation trend. This week, the hashrate has remained in a wide range of 833.26 EH/s to 1237.70 EH/s, with strong overall volatility but the center of gravity still remains above 1 ZH/s.

From a trend perspective, while the Bitcoin network hashrate experienced significant fluctuations, its core support levels remained stable. This week's hashrate trend underwent a clear process of decline and recovery: around December 15th, the hashrate experienced a temporary pullback, reaching a weekly low of approximately 833.26 EH/s, forming a distinct trough. However, the hashrate subsequently demonstrated strong resilience, experiencing a rapid and powerful vertical rebound on December 16th, quickly breaking through the 1.2 ZH/s mark. This rapid V-shaped reversal indicates that although short-term pullbacks may be affected by factors such as electricity costs, price fluctuations, or mining rig adjustments, the mining community's willingness to deploy hashrate remains strong, and the network quickly returned to a stable high level of 1.11 ZH/s (as of December 19th) after a brief adjustment.

Weekly Bitcoin network hashrate data

Weekly Bitcoin network hashrate data

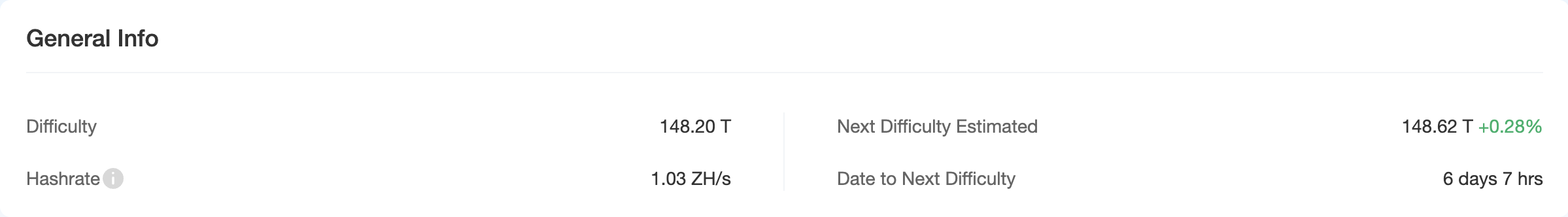

As of December 19, the total network hashrate reached 1.03 ZH/s, and the mining difficulty was 148.20T. The next difficulty adjustment is expected to take place on December 25, with an estimated increase of 0.28%, bringing the adjusted difficulty to approximately 148.62T.

Bitcoin mining difficulty data

Bitcoin mining difficulty data

Bitcoin Hash Price Index

From the perspective of daily revenue per unit of computing power (Hashprice), Hashrate Index data shows that as of December 19, 2025, Hashprice was $36.47/PH/s/day. This week, Hashprice showed an overall downward trend, falling from its initial high and maintaining a weak, volatile pattern.

- December 12: This week's high was $39.49/PH/s/day

- December 19: Weekly low of $36.25/PH/s/day

Hashprice's core drivers remain Bitcoin price and on-chain transaction demand. Looking at the 7-day price movement, although the Bitcoin price remained at a relatively high level of $85,659, the Fees in Blocks (24h) were only 0.61%, indicating extremely low on-chain transaction fees that failed to provide miners with additional excess returns. Affected by this, coupled with the network hashrate (7D) remaining at a high level of 1044.88 EH/s, the profitability per unit of hashrate continued to be diluted. The chart shows significant declines on December 15th and 19th, although there was a brief rebound to above $37.80 on the 18th, but this lacked sustainability, indicating market pressure on current profitability levels.

Based on industry data, the Bitcoin network is currently operating in an extremely competitive environment. As of December 19th, the network hashrate remained stable at 1.03 ZH/s, and the mining difficulty remained at 148.20 T. It is worth noting that the next difficulty adjustment on December 25th is expected to see a slight increase of +0.28%, at which point the difficulty may reach 148.62 T.

Overall, this revision of the expected difficulty increase instead of decrease indicates that although the current hashprice per unit of computing power is low, the overall network hashrate remains solid, and there has been no large-scale shutdown. The difficulty continues to approach the high level of 148.62 T, meaning that the output per unit of computing power will be further compressed. The mining ecosystem is shifting from simple hashrate expansion to a more brutal phase of "improving the efficiency of existing resources." With the difficulty about to reach a new high, only miners with significant advantages in call costs and high-efficiency machines can build an effective safety margin.

Hashprice data

Hashprice data

4. Policy and Regulatory News

New Regulations for Hong Kong Virtual Asset Trading Platforms (Part 1): Circular Regarding the Sharing of Liquidity among Virtual Asset Trading Platforms

On December 16, it was reported that the Hong Kong Securities and Futures Commission (SFC) issued two new circulars, clarifying the latest regulatory expectations for SFC-licensed virtual asset trading platform operators. The circulars put forward new requirements for increasing the liquidity of virtual asset trading platforms and expanding the products and services offered by the platforms.

First, a shared order book refers to a unified order book jointly managed and shared by two or more virtual asset trading platforms. It can merge trading orders from different platforms into a single matching system, forming a cross-platform liquidity pool.

In the traditional model, different trading platforms maintain their own independent order books. After a user places an order or places a pending order, the platform registers it in its internal system and matches the trades. This step is called "order matching." With the introduction of a shared order book mechanism, trading platforms in different countries or regions can pool their buy and sell orders into the same "trading pool" for matching, which is the source of increased liquidity.

Sharing liquidity sounds very appealing, but to what extent can it actually be shared? According to this circular, it's not possible yet. The circular explicitly stipulates that listing lists can only be shared between Hong Kong licensed exchanges and their "globally affiliated" virtual asset trading platforms. In other words, Haskey Exchange can only access liquidity from trading platforms in other regions within the HashKey Global group.

This circular reiterates Hong Kong's regulatory stance: it's not about not opening up, but about opening up in a compliant manner. Overseas platforms with weaker regulatory standards or insufficient compliance capabilities will find it difficult to join this system. International platforms wishing to access Hong Kong's shared data storage system must upgrade their monitoring systems.

US banking regulations allow banks to act as intermediaries in the crypto space industry.

On December 16, it was reported that US regulators announced that banks can act as intermediaries in "riskless principal" transactions in crypto trading. This further reduces the legal barriers for traditional financial institutions to enter the crypto market and is conducive to improving liquidity and legal participation.

The significantly lowered entry threshold for institutional funds is a boon for mainstream assets such as Bitcoin.

In the past, many institutions were constrained by compliance requirements and could only indirectly or observe the crypto market.

With banks acting as intermediaries, a chain reaction will occur: pension funds, family offices, and corporate treasury; they can participate in crypto transactions compliantly through the banking system; and they do not need to directly connect to exchanges or on-chain platforms.

The US's allowance of banks to act as intermediaries in cryptocurrency transactions marks the formal entry of crypto assets into the traditional financial services system. This not only lowers the entry barrier for institutions but also provides more stable liquidity and compliance support for mainstream assets such as Bitcoin, sending a clear signal of positive medium- to long-term policy benefits.

Related images

Related images

The U.S. OCC has approved a major crypto company's application for a National Trust Bank license.

On December 16, the U.S. Office of the Comptroller of the Currency (OCC) conditionally approved applications for national trust bank licenses from five crypto companies, including Circle and Ripple. This marks a significant institutional step towards deeper integration of digital assets with the traditional financial system. The new licenses allow for interstate operation of digital asset custody and payment services, but not deposit or traditional banking operations.

The Office of the Comptroller of the Currency (OCC), as one of the core regulatory bodies of the U.S. banking system, has conditionally approved applications for National Trust Bank licenses from crypto companies such as Circle and Ripple. This essentially means that:

For the first time, crypto assets have been formally incorporated into a "national banking regulatory framework," rather than remaining on the fringes of the financial system.

The OCC's approval of a national trust bank license for a crypto company signifies that the United States has officially incorporated crypto assets into its national financial regulatory system. This is a significant institutional benefit for the crypto industry as it moves towards long-term compliance and institutionalization.

UK regulatory proposals establish encryption rules consistent with traditional finance.

On December 16, the UK Treasury and the FCA released a draft of new regulations, proposing to draw on traditional financial regulatory systems to include crypto platforms in rules similar to those for securities and derivatives, while strengthening transparency, anti-money laundering, and investor protection mechanisms. This will help the UK become a global crypto regulatory hub.

This will open a continuous channel for institutional funds, rather than short-term speculative funds, to Bitcoin and mainstream crypto assets.

For the market, uncertainty itself is the greatest risk. With a clear regulatory framework, long-term funds are more willing to enter. Reducing the institutional risk premium enhances the "safety margin" of crypto asset valuations.

The UK's inclusion of crypto within its traditional financial regulatory framework is not intended to suppress the industry, but rather to pave the way for institutional funding, long-term capital, and compliant innovation. This is a significant step for the crypto market towards the mainstream financial system and is a medium- to long-term positive for the crypto market.

5. Bitcoin-related news

Michael Saylor hints at further BTC purchases;company holds $58.5 billion worth of BTC.

On December 15th, Strategy Chairman Michael Saylor hinted at another Bitcoin purchase after the price of Bitcoin fell to a two-week low of $87,600 late Sunday. Saylor posted "Back to More Orange Dots" on the X platform, suggesting another Bitcoin buy. Strategy's most recent purchase was 10,624 BTC on December 12th, its largest single purchase since late July. Strategy currently holds 660,624 BTC.

A US-based Bitcoin company recently increased its holdings by 613 BTC, bringing its total holdings to $444 million.

On December 15th, according to on-chain analyst Emmett Gallic, a US Bitcoin company associated with Trump increased its Bitcoin reserves by 613 BTC in the past 7 days, bringing its total holdings to 4,931 BTC, worth $444 million. Of this, 70 BTC came from mining revenue, and 542 BTC, worth $50 million, came from strategic purchases.

Strategy invested $980.3 million to acquire 10,645 Bitcoins.

On December 16th, according to an official announcement, Strategy& Inc. announced the purchase of 10,645 bitcoins, costing approximately $980.3 million, at an average price of approximately $92,098. The company now holds a total of 671,268 bitcoins, with a total investment of approximately $50.33 billion, at an average price of approximately $74,972.

Matador Technologies plans to raise an additional $75 million to increase its Bitcoin holdings.

On December 17th, Canadian-listed Bitcoin treasury company Matador Technologies announced a revision to its previously announced $100 million convertible note financing agreement. The revision discloses that it has signed registration agreements with investors to raise a total of $75 million through the issuance of additional notes. These funds will be used to purchase Bitcoin to bolster Matador's balance sheet. However, Matador Technologies removed its previously announced plan to hold 6,000 Bitcoins by 2027 from its latest disclosure.

Hyperscale Data increased its Bitcoin holdings to approximately 498 coins and allocated $31.5 million for further purchases.

On December 18, Hyperscale Data, a NYSE American company, announced that it will allocate approximately $75 million to its Bitcoin treasury, representing about 97.5% of the company's market capitalization. Its wholly-owned subsidiary, Sentinum, currently holds 498.4633 Bitcoins (including 428.7868 Bitcoins acquired on the open market and approximately 69.6764 Bitcoins from its Bitcoin mining operations), and has also allocated $31.5 million in cash to continue purchasing Bitcoins on the open market.

XXI CEO: The company will significantly increase its Bitcoin holdings.

On December 18th, ChainCatcher reported that The Bitcoin Historian posted on the X platform that XXI CEO Jack Mallers stated during a Bloomberg livestream that the company would "significantly increase its Bitcoin holdings."

CIMG, a publicly listed company, spent $24.61 million to increase its holdings by 230 BTC, bringing its total holdings to 730 BTC.

On December 18, PR Newswire reported that Nasdaq-listed CIMG Inc. announced it had used approximately $24.61 million of internal funds to purchase 230 bitcoins, bringing its total bitcoin holdings to 730.

CIMG stated that the current crypto market is in a "cooling-off period," which is also a strategic time to enter the market and buy.

American Bitcoin adds over 1,000 bitcoins.

December 19th news, recently American Bitcoin has increased its holdings by over 1,000 bitcoins.

Its total BTC reserves have risen to approximately5,044

Furthermore, it surpassed some of its peers in the corporate treasury rankings, demonstrating the company's trend of expanding its BTC balance sheet through an open market purchasing strategy.

B HODL, a BTC vault company, increased its holdings by 2.17 BTC, bringing its total holdings to 157,211 BTC.

On December 19th, according to NHASH, B HODL, an enterprise-grade BTC vault company, announced that it recently added to its Bitcoin reserves, purchasing approximately 2.17 BTC. As of now, the company's total Bitcoin holdings have reached approximately 157,211 BTC.

Brazilian listed company OranjeBTC increased its holdings by 7.3 BTC, bringing its total holdings to 3,720.3 BTC.

On December 19th, according to official disclosures, Brazilian listed company OranjeBTC continues to expand its asset reserves, recently buying more Bitcoin at market lows, adding approximately 7.3 BTC. As of now, the company's total Bitcoin holdings have reached approximately 3,720.3 BTC.

Cathie Wood revealed her three most favored crypto assets: BTC, ETH, and SOL.

On December 15th, Ark Invest Tracker released an interview video with ARK Invest founder Cathie Wood on the X platform. In the video, she listed her three most favored crypto assets: Bitcoin as a global monetary system and institutional entry point, Ethereum as an institutional-grade infrastructure layer, and Solana, a consumer-centric blockchain.

Eric Trump: Bitcoin has no "management" and therefore no issues of corruption, fraud, or abuse.

On December 15th, Eric Trump, the second son of Donald Trump, stated on the Full Send podcast that Bitcoin's total supply is fixed at 21 million coins, a "beautiful" design that prevents its supply from expanding through continuous mining like commodities such as gold. This finiteness creates genuine scarcity, making it a global asset.

Furthermore, it stated that Bitcoin is easier to transfer globally compared to gold, and that Bitcoin has no "management," therefore there are no issues of corruption, fraud, or abuse.

Wu Jiezhuang: Hong Kong's stablecoin development will move steadily forward; different industries can try bold experiments combining RWA and Web3.

On December 15th, Hong Kong Legislative Council member Wu Jiezhuang posted on the X platform, stating that he will continue to promote the development of Web3 in Hong Kong. He shared his views on topics including the future of stablecoins and the development of RWA, as follows:

We believe that the development of stablecoins in Hong Kong will not undergo significant changes and will continue to move steadily forward. The Stablecoin Ordinance Bill, passed by the seventh Legislative Council, is the result of a long period of deliberation and discussion. Overall development will align with the actual international and Hong Kong financial environment, proceeding steadily, starting with the local market as a trial, with the goal of developing the international market and leveraging Hong Kong's position as a financial and innovation hub.

RWA (Responsive Web Applications) is a widely discussed topic in both traditional and Web3 industries. Hong Kong has already implemented a regulatory sandbox, which will likely explore the importance of compliant development and the future direction of regulation. It is believed that different industries can boldly experiment with Web3 technologies, which will drive the development of numerous real-world applications.

Developer demand is increasing rapidly. More and more companies involved in Web3 public chains, compliant trading platforms, and underlying infrastructure are establishing operations in Hong Kong. The success of developers is inextricably linked to that of innovative technology companies, and in the future, this will help the industry build a talent ecosystem, encouraging more developers and professionals to settle in Hong Kong.

Michael Saylor: Still bullish on Bitcoin

On December 16, Strategy founder Michael Saylor posted an article stating that he remains bullish on Bitcoin (Still ₿ullish).

As previously reported, Strategy added another 10,645 Bitcoins last week, for a total value of approximately $980.3 million, or about $92,098 per Bitcoin. As of December 14, 2025, Strategy holds 671,268 Bitcoins, with a total cost of approximately $50.33 billion, or about $74,972 per Bitcoin.

Related images

Related images

Tom Lee: Bitcoin could rise to $250,000 within months, and Ethereum could reach $12,000.

On December 16th, Tom Lee, Chairman of BitMine, an Ethereum treasury firm, stated at Binance Blockchain Week that he expects Bitcoin to rise to $250,000 within months. He also noted that if the Ethereum-to-Bitcoin price ratio returns to its average level over the past eight years, the price of Ethereum could rise to approximately $12,000. He pointed out that Ethereum has begun to break out of its five-year trading range, and the asset tokenization trend in 2025 will enhance Ethereum's use value.

Bernstein: Bitcoin has broken its four-year cycle and is currently in a prolonged bull market.

On December 17, Bernstein analysts stated that Bitcoin has broken its four-year cycle pattern and is currently in an extended bull market cycle. The analysts also raised their target price, predicting that Bitcoin will reach $150,000 in 2026 and peak at $200,000 in 2027.

Tom Lee: I don't believe this wave of Bitcoin has peaked; it may reach a new all-time high before the end of January next year.

On December 19th, according to a video shared by crypto KOL AB Kuai.Dong, Fundstrat co-founder and BitMine chairman Tom Lee recently stated in an interview with CNBC: "I don't think this wave of Bitcoin has peaked. We were too optimistic about reaching new highs before, but I'm confident that Bitcoin should reach a new all-time high by the end of January. Therefore, not only Bitcoin, but also Ethereum and the entire crypto market."