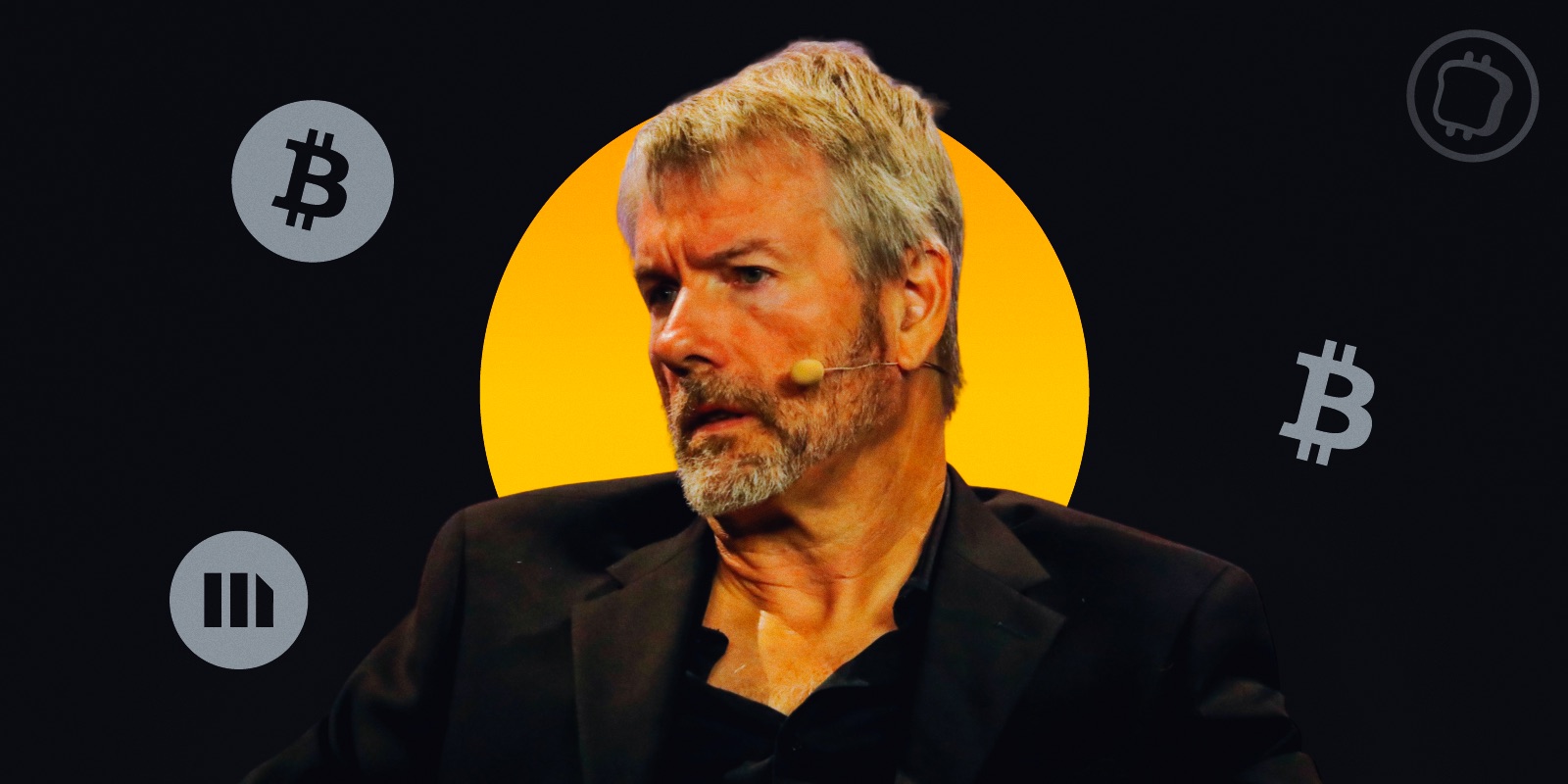

At the crossroads of global finance and technological innovation, Michael Saylor continues to redefine traditional monetary paradigms through his bold assertions and unrelenting faith in disruptive innovation. The MicroStrategy CEO unapologetically declares: "Bitcoin’s market capitalization will ultimately reach $500 trillion." This audacious vision not only reflects extreme optimism for Bitcoin’s future but also underscores the urgent global shift toward digitization and decentralization in economic systems.

The Bitcoin Bull

Michael J. Saylor, renowned entrepreneur and CEO of MicroStrategy, has cemented his status as a vanguard of digital-era investing through his strategic acumen in corporate governance and technological foresight. Long before Bitcoin entered mainstream discourse, Saylor dissected its value proposition, identifying its gold-like scarcity and inherent advantages over traditional assets. As an early institutional adopter, his words and actions have profoundly shaped global investor sentiment toward cryptocurrencies.

Bitcoin’s Core Value Proposition

Since its 2008 inception, Bitcoin has captivated the world with its decentralized architecture, transparency, and tamper-proof security. Its foundational strengths lie in three pillars:

Finite Supply & Scarcity

Capped at 21 million coins, Bitcoin’s programmed scarcity positions it as a natural hedge against inflation and currency debasement. Mirroring gold’s historical role as "hard money," Bitcoin is increasingly hailed as "digital gold" for its long-term store-of-value potential.

Decentralization & Trustless Consensus

Powered by blockchain technology, Bitcoin eliminates intermediaries through peer-to-peer transactions validated by a global network of nodes. This creates a transparent, self-governing system that grants users unprecedented financial sovereignty.

Global Liquidity & Adoption

As institutional and retail investors integrate Bitcoin into portfolios, its liquidity surges. From cross-border settlements to digital asset custody, Bitcoin’s borderless efficiency fuels its expanding utility—a critical foundation for market cap growth.

Economic Rationale Behind the $500T Forecast

Saylor’s $500 trillion projection is grounded in macroeconomic realities, monetary policy trends, and technological inevitability:

Fiat Devaluation & Inflation

Unprecedented quantitative easing and currency dilution have eroded traditional money’s purchasing power. Bitcoin’s scarcity positions it as a magnet for capital fleeing inflationary risks, potentially unlocking trillions in sidelined liquidity.

Institutional Portfolio Revolution

The accelerating digitization of finance is forcing institutions to rethink asset allocation. Saylor argues Bitcoin’s trustless architecture will dominate the restructuring of global capital, challenging traditional financial hegemony.

Techno-Economic Paradigm Shift

Just as the internet reshaped media and commerce, Bitcoin’s blockchain is redefining money itself. Advancements in scalability, energy efficiency, and payment infrastructure could integrate Bitcoin into daily economic life, driving exponential revaluation.

Prerequisites & Challenges

Achieving a $500 trillion market cap demands seismic shifts:

-

Global Regulatory Acceptance: Recognition of Bitcoin as a legitimate reserve asset by governments and financial institutions.

-

Infrastructure Overhaul: Seamless integration of Bitcoin into banking, payments, and custodial systems.

-

Technological Evolution: Solving scalability, energy consumption, and transaction cost hurdles while maintaining security.

Key Risks:

-

Regulatory Volatility: Divergent global policies could stifle adoption.

-

Market Turbulence: Extreme price volatility may deter conservative capital.

-

Technical Limitations: Network upgrades must outpace demand growth.

Digital Gold vs. Legacy Stores of Value

Bitcoin’s "digital gold" narrative transcends scarcity—it represents a new trust architecture for the internet age. While gold remains a millennia-old wealth symbol, Bitcoin’s programmability and global liquidity are redefining value preservation. This clash mirrors historical inflection points where technological revolutions toppled entrenched systems.

Epilogue

Michael Saylor’s $500 trillion prophecy embodies both techno-optimism and a critique of archaic financial systems. While the path is fraught with uncertainty, it compels humanity to reimagine wealth, risk, and trust in the digital age. As blockchain technology reshapes our economic fabric, Bitcoin may well emerge as the defining asset of this transformation—a beacon in the storm of progress.